Payment Processing Fees, Convenience-Service Charges, and Sales Tax… OH MY!

COVID-19 has increased the demand for sports, entertainment and live event venues to move away from cash dependency. This trend had been happening before the pandemic, given the many downsides of cash liabilities including handling, safekeeping and accounting.

On the other hand, credit and debit card payment, mobile payment and other forms of touchless payments have proven to be way more efficient, hygienic and cost-effective. This gives customers the assurance to make them feel safe and comfortable after returning to live-action, with faster speed of service, shorter lines and limited concourse congregation. It’s beneficial for venue operators too, since we’ve witnessed first-hand how mobile ordering and payment can effectively increase the average spend and per caps over time.

As a result, our industry has quickly been introduced to the inherent cost-considerations that come with these cashless endeavors. In some cases, creating unnecessary fear and concerns.

What are some categories of cost associated with mobile transactions and what fees do you need to be aware of? We’ll break it down for you in this blog.

Payment Processing Fee

- This fee refers to the cost incurred by a venue operator for processing credit card payments and online payments from customers.

- Typically, this fee is charged per transaction.

- The average payment processing fee may range anywhere from 1.5% to 3.5% on every transaction.

- It’s important to note, this fee is unavoidable, and is charged by the payment processor (such as Square, Stripe, Freedom Pay etc.).

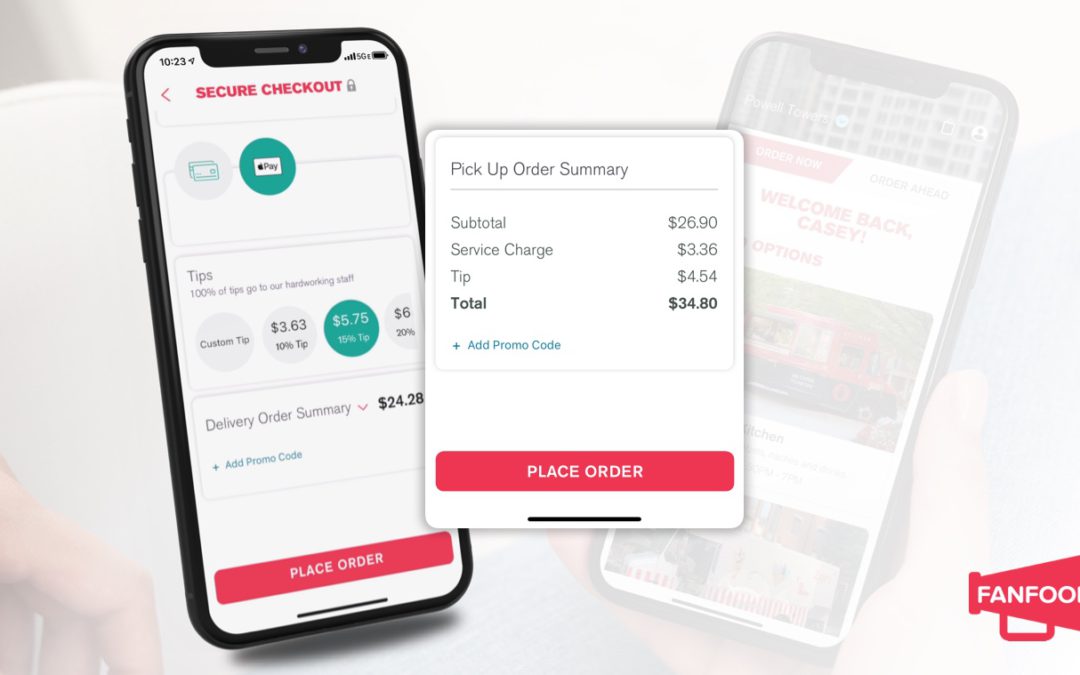

Convenience and/or Service Charge

- This fee is an additional charge related to the purchase of a product or service.

- Often, this fee is collected to pay for the services related to the product being purchased.

- Convenience and/or Service fees are different from tips, in that tips are discretionary. Customers may tip at their discretion while Convenience or Service Charges are automatically applied to the customer’s bill.

- This fee could be a percentage of the order value, or a fixed fee per order.

Sales Tax

- This fee is imposed by the government for the sale of certain products and services.

- The sales tax is collected at the point-of-sale by the operator and then passed onto the government.

- Typically, when cash was the preferred method of payment, sales tax was “baked” into the price displayed for food and beverage.

What does this mean for us and our operations going forward? Ultimately, it’s up to you and how you want to approach your concession pricing.

For example, with sales tax, we might have previously sold a hotdog for $5, keeping $4 for ourselves and paying $1 back in taxes. Now, through digital payments, we can sell the same hotdog for $6, adding the sales tax on top as a separate line item.

In this instance, we’ve made more money, selling the same product – not to mention, at a safer and faster transaction speed.

The same rule applies to convenience and/or service charges. To date, we’ve experienced no pushback from customers. People expect convenience, and that goes for the “cost” associated with it too. We’ve all grown accustomed to these fees in other areas of our life; think about the Starbucks coffee, or the takeout meal you ordered this week…

As an indirect benefit, convenience fees & service charges also allow us to offset payment processing fees.

Perhaps the greatest — and slightly unintended — benefit of mobile payments has been the increase in tipping. One of my favorite comments around this uptick is, “…cashless technology helps get the tip buckets off of the counter.”

Our partners play a tremendous role in the local community; these are tough times and fans know your staffers are working hard — they want to help. Venues can choose to collect all tips or distribute them to nonprofit volunteer groups that operate concessions to raise money.

Get to know these important terms (payment processing, convenience-service fees, sales tax), and tactfully approach how you choose to implement them within your operations. When done correctly, this can have a positive impact on our bottom line.

—————————————————————————————————————————————————————————

To see a quick video of FanFood mobile ordering platform, or request a full demo, visit fanfood.app/demo

Recent Comments